Alternative Financing: A Lifeline For Small Business Growth

Small Business Loan Hub distinguishes itself in this evolving landscape by incorporating working capital cycle analysis into its lending practices. This unique approach ensures that businesses receive financing solutions that are precisely aligned with their cash conversion cycle, making them one of the few lenders that truly understand and address the complete spectrum of small business working capital needs.

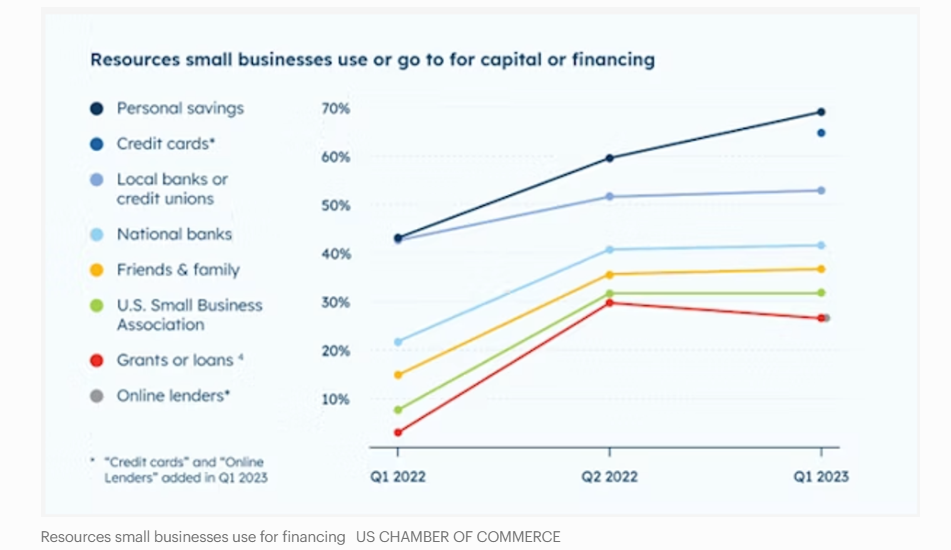

The landscape of small business financing has evolved dramatically, as evidenced by recent data from the U.S. Chamber of Commerce. Traditional funding sources remain out of reach for many entrepreneurs, with 70% relying on personal savings and over 60% turning to credit cards for capital needs.

The Rise of Alternative Lending

The traditional funding gap has given birth to a robust alternative financing ecosystem. These modern lending solutions provide more accessible paths to capital, often with more flexible qualification requirements than conventional banks.

Digital Lending Platforms

Online lenders have emerged as a significant force in small business financing, showing steady growth in adoption rates since 2022. These platforms leverage technology to streamline the application process and can typically provide faster approval decisions than traditional banks.

Working Capital Cycle

Also known as the cash conversion cycle, this represents the time it takes for a business to convert resource inputs into cash flows from sales. Understanding this cycle is crucial for businesses to optimize their working capital needs and determine the most appropriate financing solutions. This cycle encompasses the entire process from purchasing inventory to collecting payment from customers.

Advantages of Alternative Financing

Speed and Accessibility

While local and national banks show consistent usage rates of around 50% and 40% respectively, alternative lenders often provide faster funding solutions with less stringent requirements.

Flexible Terms

Alternative financing often offers more adaptable repayment structures that align with business cash flow patterns, unlike traditional fixed-payment loans.

Core Working Capital Solutions

– Inventory Financing: Enables businesses to purchase inventory by using the inventory itself as collateral

– Accounts Receivable Financing: Allows businesses to receive immediate cash against their outstanding invoices

– Purchase Order Financing: Provides funding based on confirmed purchase orders from creditworthy customers

Market Trends and Growth

The data shows a clear upward trend in the adoption of alternative financing methods. From Q1 2022 to Q1 2023, online lenders have steadily increased their market presence. This growth indicates both the increasing acceptance of alternative financing and the expanding need for more accessible capital solutions.

Strategic Implementation

Assessment and Planning

Businesses should evaluate their specific needs and cash flow patterns to determine which alternative financing products best align with their growth strategy.

Risk Management

While alternative financing provides easier access to capital, businesses must carefully consider:

– Total cost of capital

– Repayment terms

– Impact on cash flow

– Personal guarantee requirements

Future Outlook

The alternative financing sector continues to evolve, with technology playing an increasingly important role. The trend lines from the U.S. Chamber of Commerce data suggest sustained growth in this sector, particularly as traditional lending requirements remain stringent.

Conclusion

Alternative financing has emerged as a crucial solution for small businesses facing traditional funding challenges. As the sector matures, it continues to provide innovative solutions that bridge the gap between conventional lending requirements and the real-world needs of small businesses. The growing adoption rates of these alternative funding sources, as shown in the Chamber of Commerce data, validate their importance in the small business ecosystem and suggest a continuing evolution of the financing landscape.